Legal Barriers

1

Accessing Institutions

Limitations on women’s legal capacity weaken their decision-making ability. When women cannot independently decide where they want to go on a daily basis, travel, or live, they may face difficulty getting to work or conducting business transactions.

2

Building Credit

When women face constraints, including discrimination and limited credit history, in accessing credit, their ability to open formal bank accounts, build reputation collateral for loans, find employment, and start and grow businesses is impeded.

3

Getting a Job

Legal barriers that affect a woman’s ability to work, including gender-based job restrictions and the lack of workplace protections and leave benefits, inhibit her job prospects, earning potential, career growth, and ability to balance work and family.

4

Going to Court

Barriers in the justice system prevent women from advocating for their interests and enforcing the law. The cost of litigation can discourage poor women from accessing justice, and unequal treatment in court can undermine women’s legal capacities.

5

Protecting Women From Violence

Women can function more freely in societies and the business world when not faced with the threat of violence. Violence against women can undermine women’s careers, ability to work, access to financial resources, and the employment climate.

6

Providing Incentives to Work

Support for mothers—such as tax credits and the availability of childcare for young children—can reduce unequal burdens and provide incentives for women to enter and remain in the workforce, thereby increasing women’s labor force participation.

7

Using Property

Access to property benefits women entrepreneurs by increasing their financial security and providing them with the necessary collateral to start businesses. Legal differences in property ownership and inheritance rights can limit women’s economic prospects.

Moving Toward Reform

Governments around the world are beginning to understand the cost of inequality for women in the workplace, and to take action. Between 2015 and 2017, over 110 countries and territories carried out more than 180 reforms that improved women’s economic opportunities. Governments should also do more to implement existing laws and policies that provide for women’s equality.

110+

Countries

180+

Positive Reforms

Understanding the Economic Stakes

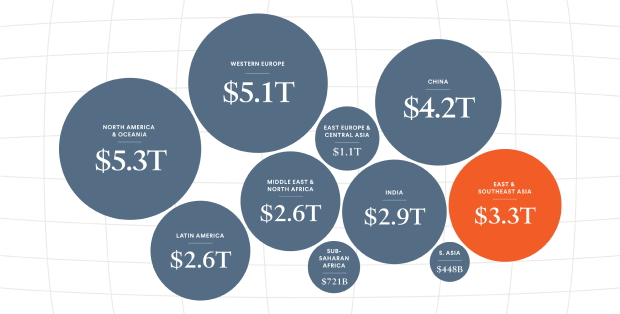

Closing the gender gap in the workforce could add a staggering $28 trillion to the global gross domestic product (GDP). Find out how women’s economic participation reduces poverty and boosts growth.

See the interactive reportBuilding Credit

By the Numbers

153 countries do not prohibit discrimination by creditors on the basis of marital status.

132 countries do not require retailers to provide information to private credit bureaus or public credit registries.*

129 countries do not require utility companies to provide information to private credit bureaus or public credit registries.*

117 countries do not prohibit discrimination by creditors on the basis of gender.

* Information on women’s credit history can help women without property build their reputation collateral to better access loans.

Economic Effects

In countries that legally prohibit discrimination in access to credit based on gender, more women have debit cards in their own names and formal bank accounts at financial institutions.

Source: World Bank

In the United States, prior to the passage of the 1974 Equal Credit Opportunity Act, banks often had explicit policies to treat women differently than men. When the act prohibited sex-based classifications and income discounting, women were better able to access credit, including for mortgages.

Source: World Bank

Country Example

Karishma Amin, a thirty-year-old Indian woman, was ready to purchase a home, but she struggled to find a bank that was willing to give her a loan. Amin was single, and numerous institutions turned her away because she did not have a male co-applicant. In India, financial institutions are not prohibited from discriminating in access to credit based on gender or marital status. This hinders women’s ability to build collateral for loans, secure property, and enjoy economic opportunity.

Source: Economic Times (India)

Policy Reform

Prohibiting gender discrimination by creditors and increasing women’s access to finance allows women to take collateral for loans and build their businesses. Countries should:

Enact legislation that prohibits gender discrimination in financial services.

Thirty-two countries and territories changed laws and processes affecting women’s access to credit between 2015 and 2017.

No reforms were undertaken between 2015-2017 related to women’s workplace equality.

Increased gender parity

Neutral to gender parity

Decreased gender parity